If you’re thinking about entering the real estate industry in British Columbia, you might be wondering:

Should I get a real estate license, a mortgage broker license, or both?

It’s a common question — and the right answer depends on your personality, career goals, and the kind of day-to-day work you want to do. In this article, we’ll break down the differences, lifestyle considerations, earning potential, and pros and cons of each path so you can make the best choice for your future.

This article will compare both careers in BC, covering lifestyle, commission structure, passive income opportunities, time to get licensed, and earning potential — so you can choose the path that’s right for you.

Prefer to watch instead of read? Check out our GOBC Real Estate School video where we break down:

-

The main differences between the two licenses

-

What the day-to-day work looks like

-

Lifestyle and flexibility for each path

-

Earning potential and how commissions work

Click the image above to watch the full video on YouTube.

What’s the Difference?

Real Estate License

With a real estate license in BC, you can represent clients in buying, selling, or renting properties. Your role is focused on real estate transactions, marketing homes, and guiding clients through negotiations and closings.

-

Regulated by: BC Financial Services Authority (BCFSA)

-

Training: Real Estate Trading Services Licensing Course (via UBC Sauder School of Business)

-

Work Environment: Independent (under the brokerage supervision)

-

Core Skills: people-person, client relationship building

Lifestyle as a Real Estate Agent

-

Flexible but often irregular schedule — many client showings and open houses take place evenings and weekends when buyers are available.

-

Time split between calling, client meetings, property showings, and networking.

-

Opportunity to be out in the community daily, meeting new people.

-

Requires self-motivation and discipline, especially if working independently.

-

Can involve periods of intense activity followed by slower weeks.

-

Work for Yourself: Most Realtors are independent contractors under a brokerage, meaning you run your own business, set your own goals, and choose your marketing style — but you’re also responsible for generating your own clients.

-

Full-Time or Part-Time: In BC, real estate can be done full-time or part-time, depending on your income needs and lifestyle goals.

Mortgage Broker License

A mortgage broker license allows you to help clients secure the best mortgage products for their needs, connecting them with lenders and negotiating loan terms. Your focus is on financing, not buying or selling the property itself.

-

Regulated by: BC Financial Services Authority (BCFSA)

-

Training: Mortgage Brokerage in BC Course (via UBC Sauder)

-

Work Environment: Independent, within a brokerage, or in-house at a bank/credit union

-

Core Skills: Problem solving, client trust building, be able to sit in front of computer for long period of times

Lifestyle as a Mortgage Broker

-

Usually a more structured schedule — often Monday to Friday, 9–5, with weekends off unless you choose to work extra hours for clients.

-

Often work-from-home with flexible hours and no face-to-face meetings required — most client and lender communication happens via phone, email, or video calls.

-

Day-to-day tasks include reviewing applications, arranging pre-approvals, and coordinating with lenders.

-

Networking with Realtors, lawyers, and other referral partners can be done entirely online.

-

Ideal for those who want location independence and minimal travel.

-

Work for Yourself: Many mortgage brokers are self-employed contractors under a brokerage. You decide how to market your services, build your client base, and structure your workweek.

-

Full-Time vs. Part-Time: While mortgage brokering can technically be done part-time, it’s more challenging to break in this way — many offices prefer full-time brokers due to training costs, licensing oversight, and client service expectations.

Time to Get Licensed – Fast Track to a High-Earning Career

One of the most appealing parts of becoming a real estate agent or mortgage broker in BC is how quickly you can get started compared to other high-earning professions.

For Real Estate and Mortgage Brokering:

-

Most people complete the required UBC Sauder licensing course and exam preparation within 2–4 months (with fast-track school help).

-

You don’t need a university degree — just meet the basic eligibility requirements and pass the licensing exam.

-

Once licensed, you can start earning commissions almost immediately if you join a supportive brokerage.

Compare that to Becoming a Doctor:

-

Education Timeline: 8+ years of post-secondary education (undergrad + medical school), followed by years of residency.

-

Cost: Tens of thousands in tuition, plus years without significant earnings.

-

Earning Potential: Similar six-figure income potential to top-performing real estate professionals — but with a much longer runway.

Income Potential – How You Get Paid

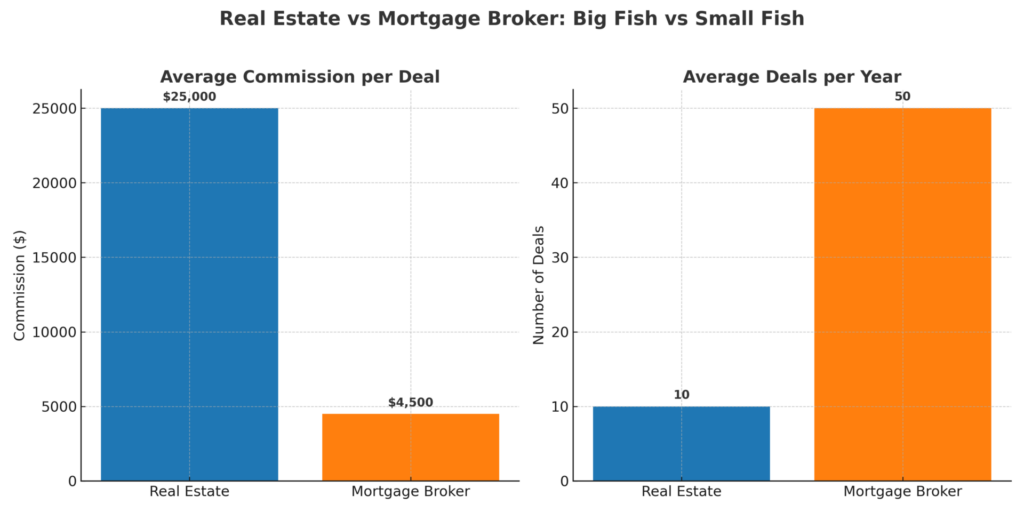

Real Estate License

-

Commission Structure: Agents in BC typically earn a percentage of the property’s sale price. On a $1,000,000 home, for example, commissions could range from $20,000–$30,000 (shared with the brokerage- 80/20 or 70/30 split).

-

Sales Volume: Because properties take time to sell, you may close fewer deals in a year, but each one can produce a large payday.

-

Analogy: Real estate is like fishing for a big catch — you invest time and effort to land a big deal, and when it happens, the reward is significant.

Mortgage Broker License

-

Commission Structure: Brokers typically earn a commission from the lender, often around 0.8%–1% of the mortgage amount. On a $500,000 mortgage, that could be $4,000–$5,000.

-

Sales Volume: Because mortgages are needed for almost every home purchase and many refinances, brokers tend to do more deals per year, each with a smaller payout than a real estate sale.

-

Analogy: Mortgage brokering is like fishing for lots of smaller fish — the individual payouts are smaller, but the steady volume creates consistent income.

The Balance

-

Real estate = high commission, fewer sales.

-

Mortgages = smaller commission, more sales.

-

Many professionals choose to hold both licenses, catching both “big fish” and “small fish” for a balanced income stream.

Passive Income Opportunities

For Real Estate Agents:

-

Build a Team: Hire licensed team members to work under you, earning a portion of their commissions.

-

Earn While Away: With a strong team or referral network, you can take vacations and still close deals.

-

Create a Real Estate Portfolio: Invest in your own rental properties to generate monthly rental income while your assets appreciate.

For Mortgage Brokers:

-

Build a Client Database: Repeat business from clients refinancing or upgrading homes can provide ongoing commissions.

-

Referral Partnerships: Build a steady pipeline by connecting with real estate agents and other industry professionals.

Time to Get Licensed – Fast Track to a High-Earning Career

Real Estate & Mortgage Brokering

-

Licensing can be completed in 2–4 months using a fast-track school.

-

No university degree is required — just meet basic eligibility requirements and pass the exam.

-

You can begin earning commissions as soon as you join a brokerage after licensing.

Compare to Becoming a Doctor

-

8+ years of post-secondary education and medical training.

-

High tuition costs and years with little to no income.

-

Six-figure earning potential, but with a long delay to start.

The Advantage in Real Estate/Mortgage Brokering:

You can launch a potentially six-figure career in under a year, without the massive debt or time investment required for other high-paying professions.

Pros and Cons at a Glance

| Career Path | Pros | Cons |

|---|---|---|

| Real Estate License | High earning potential, flexible schedule, opportunity to build personal brand, passive income potential | Income can be unpredictable, competitive market, evening/weekend work |

| Mortgage Broker License | Steady demand, structured hours, work-from-home option, repeat client business | Smaller commissions per deal, more paperwork, harder to start part-time |

Which Path Fits You Best?

-

Choose Real Estate if you enjoy working with people, social media presence, and in-person client interaction.

-

Choose Mortgage Brokering if you prefer working from home, structured hours, and a steady workflow.

-

Consider Both if you want to maximize earning potential and offer a full-service experience to clients.

The Bottom Line

Whether you choose a real estate license, a mortgage broker license, or both, you’ll enter a field with strong earning potential, flexibility, and opportunities for growth.

At GOBC Real Estate School, we guide you through BC’s licensing process and prepare you to launch a successful career.

Not sure which license is right for you? Contact us today for a free career consultation and explore our licensing prep programs.

0 Comments