Over the past year, Canadians have been rethinking how—and where—they travel. Rising geopolitical tensions, a weaker dollar, border hassles, and shifting lifestyle preferences have all contributed to a powerful trend: Canadians are increasingly choosing to vacation at home rather than abroad.

This growing “Buy Canadian” and “Travel Local” mindset is now reshaping British Columbia’s recreational real estate market in ways that matter directly to real estate agents, investors, and property managers. From ski towns to lake regions to rural short-term rental (STR) friendly communities, demand patterns are shifting—and so are the opportunities.

Let’s start with the stats, to paint a more complete picture of this current BC real estate trend.

Canadians Are Staying Closer to Home (And Spending More Here)

Domestic travel is dominating Canadian tourism

- In 2024, Canadians took 330.8 million trips, and 292.1 million of them were domestic. This means 88% of all travel happened inside Canada. Domestic trips were up 3.7% year-over-year.

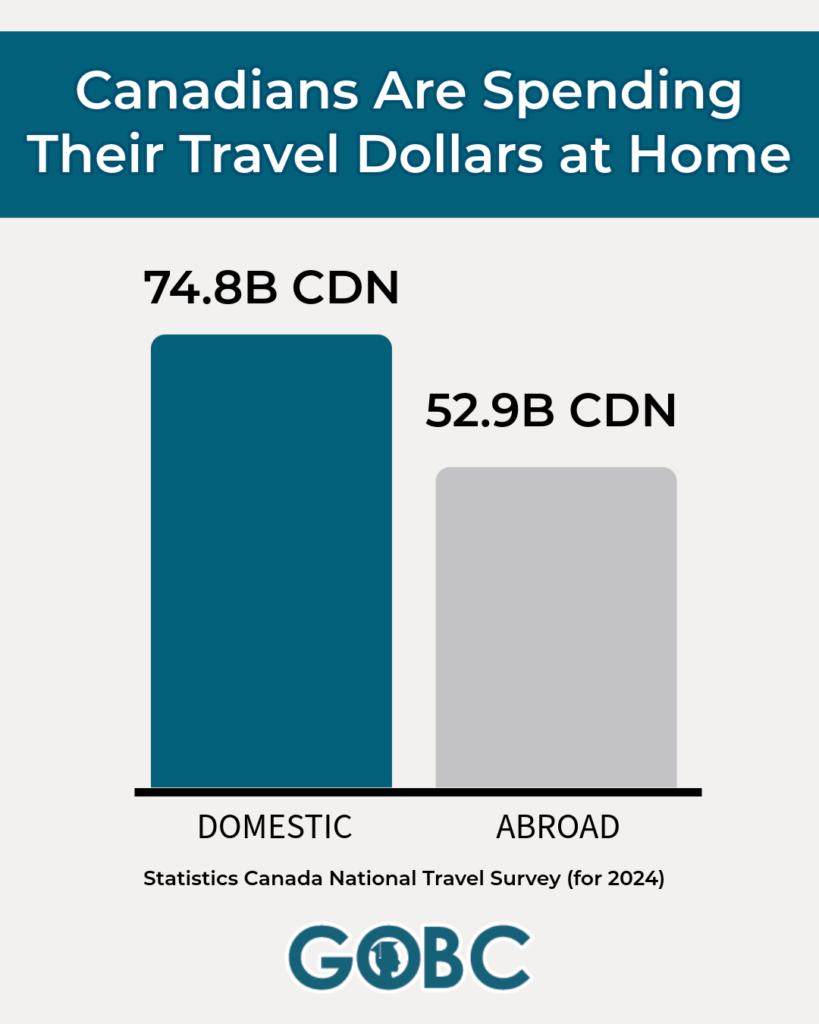

Source: StatsCan National Travel Survey (2024). - Canadians spent $74.8 billion on domestic travel (vs $52.9 billion abroad), meaning most travel dollars now stay within Canada.

Source: StatsCan. - Q4 2024 domestic travel spending alone reached $16.2B, up 11% year-over-year.

Source: StatsCan Tourism Indicators.

Travel to the U.S. has plummeted

- July 2025: Canadian trips to the U.S. dropped 32.4% year-over-year.

Source: StatsCan. - Analysts note 7 consecutive months of declining Canadian travel to the U.S., with car trips falling 36.9% and air travel 25.8% year-over-year

Source: Global news coverage of StatsCan releases.

Why this matters for real estate

When Canadians stay in Canada, they vacation more often in BC, and that demand fuels interest in recreational properties, short-term rentals, resort condos, and investment opportunities across the province.

BC Is Becoming the Default Playground for Canadian Travellers

BC has always been a favourite travel destination in Canada. BC has much to offer visitors in terms of both activities, views and culture. It makes it an easy choice for Canadians looking to get away, without leaving the country.

In fact, even BC residents themselves are traveling locally within BC

- BC residents account for 84% of Canadian visitation in the province and 76% of domestic tourism spending.

Source: Destination BC. - 9 out of 10 British Columbians have taken at least one leisure trip within BC in the past five years. Three-quarters are repeat travellers.

Source: Destination BC.

There are abundant opportunities for popular activities during the winter (downhill skiing, snowboarding, cross-country skiing, snowshoeing and sledding) and summer (water sports on the many lakes and rivers or hiking, backpacking and camping in national and provincial parks). Source: Destination BC

These travel activities, of course, align with BC’s recreational real estate regions. They are exactly the environments where demand for resort condos, cabins, STR-friendly rural homes, and strata-managed complexes is growing.

WHISTLER

Whistler Blackcomb recorded over 2.1 million skier visits in the 2023–2024 season, supporting approximately 13,000 jobs and generating an estimated $1.6 billion in annual economic output for the region.

Source: Tourism Whistler Annual Reports & Whistler Blackcomb economic impact modelling.

This showcases the scale and sustained demand driving the ski-town real estate boom.

YOHO AND GLACIER NATIONAL PARKS

Yoho National Park attracts approximately 700,000 visitors annually, with visitation rebounding sharply in 2023–2024 as Canadians chose domestic nature-based travel.

The Yoho–Glacier corridor boosts tourism economies in Field, Golden, and Revelstoke—areas now seeing rising interest from recreational buyers and STR investors.

Source: Parks Canada Visitor Use Statistics.

These examples tie directly to real estate growth in Golden, Revelstoke, and Kicking Horse resort regions.

Recreational Real Estate: BC’s Strongest-Demand Market in 2025

According to Royal LePage’s 2025 Winter Recreational Property Report:

- Winter recreational markets across Canada saw 3.8% price growth year-over-year.

Source: Royal LePage. - Median price for a detached recreational property: $982,000.

- 47% of experts say the shift is driven by a growing “Buy Canadian” mindset—buyers choosing local ski towns over U.S. or European resorts.

Source: Royal LePage.

Some of the top-performing BC markets include:

- Sun Peaks: +24.3%

- Whistler (condos): ~+20%

- Strong activity also noted in Big White, Revelstoke, Silver Star, Fernie, and Kicking Horse.

The message is clear: BC resort towns are outperforming traditional urban markets.

Investors Are Pivoting Away from Urban Airbnbs

Following BC’s Short-Term Rental Accommodations Act (May 2024) and principal-residence restrictions:

Short-term rental activity dropped sharply in major cities like Vancouver, Victoria, and Kelowna.

Source: AirDNA 2025 STR Market Impact Reports.

STR demand shifted toward exempt or rural zones, including:

- resort towns (Sun Peaks, Big White, Revelstoke, Whistler hotel-zoned units),

- tourism-dependent rural communities.

Source: AirDNA & news coverage.

Investors are now directing capital toward:

- resort condos with hotel-style rental programs,

- tourism-zoned townhomes,

- strata-managed complexes designed for nightly rentals,

- rural exempt communities where STRs remain legal.

This shift has created a surge in demand for knowledgeable property managers and strata managers who can navigate short-term rental compliance, bookings, guest turnover, maintenance cycles, and safety regulations.

The Foreign-Buyer Ban Has Accelerated Domestic Ownership

Canada’s Prohibition on the Purchase of Residential Property by Non-Canadians Act was extended to January 2027.

Source: Federal Government announcement, Feb 2024.

The effect of this Act means that BC’s recreational and resort markets are now driven almost entirely by Canadian buyers, which makes domestic travel patterns (not international investors) the dominant force behind market performance.

New Ownership Models Are Emerging (And Creating Demand for Rental Property and Strata Management Services)

As recreational markets heat up, buyers are increasingly turning to ownership structures that offer flexibility, affordability, and managed use. Essentially people are tired of the work and headaches involved with having to manage a property on their own. Or even worse, split those duties between two or more people or groups, which can get messy.

Because of this, BC is seeing rapid growth in three models:

1. Co-Ownership (Shared Purchase Between Families or Friends)

What it is

Two or more buyers jointly purchase a property and share:

- down payments,

- ongoing costs,

- usage schedules,

- appreciation and equity.

Why it’s growing

- Recreational prices have surged (Sun Peaks +24.3%).

- Families want multi-generational gathering places without full ownership burdens.

- Many Canadians use a vacation home only part time.

Why rental property and strata management services are needed

- Coordinating maintenance among several owners

- Managing cleaning/turnover for rental use

- Handling owner communication, disputes, and strata issues

Co-ownership creates complex operational needs—ideal for trained strata and rental property managers.

2. Fractional Ownership (Structured Time-Based Shares)

What it is

Buyers purchase a fraction of a property (often 1/4, 1/6, or 1/12) tied to a specific number of annual weeks. These are usually on-title and regulated—not traditional timeshares.

Why buyers choose it

- Lower purchase price (a fraction of a $900k unit costs far less).

- Guaranteed access to key seasonal weeks.

- Minimal personal responsibility for ongoing maintenance.

Why rental property and strata management services are essential

Fractional buildings require:

- high-frequency standardized cleaning,

- strict maintenance schedules,

- amenity oversight,

- precise owner rotation coordination.

Fractional resorts rely almost entirely on professional management frameworks, opening opportunities for new strata and rental property careers and contracting.

3. Managed Rental Pools (Hotel-Style Rental Programs)

What it is

A group of units join a centrally managed rental pool run by a resort operator or hotel brand. Income is split between the operator and owners.

Where these thrive

- Whistler hotel-zoned condos

- Sun Peaks resort complexes

- Big White & Revelstoke condo-hotels

- Kicking Horse tourism-zoned builds

- Tofino/Ucluelet resort townhomes

Why investors like it

- Hands-off revenue

- Hotel-style marketing & pricing strategy

- Higher occupancy than Do-it-yourself STRs

- Full compliance with BC’s STR regulations (resort zoning = exempt)

Why rental property and strata management services are vital

These complexes need:

- 24/7 guest support

- high-turnover cleaning

- amenity management

- financial reporting

- strata communication and governance oversight

Resort rental pools represent one of BC’s fastest-growing streams of managed real estate.

What This Means for Real-Estate Professionals

For real estate agents

- New client niches in ski towns, lakeside communities, and rural STR-friendly regions

- Increased need to understand STR rules, rental zoning categories, and ownership structures

- Opportunities to specialize in recreational property transactions

For investors

- More accessible entry points via co-ownership and fractional models

- Strong rental demand in resort regions

- Higher predictability with managed rental pools

- Urban Airbnb restrictions are redirecting capital to resort markets

For property & strata managers

Demand in BC’s resort regions is surging due to:

- multi-owner property models,

- year-round maintenance requirements,

- increased STR compliance needs,

- rising resort tourism,

- shortage of trained PM and ST personnel.

This represents a major opportunity for companies and individuals entering the field.

What to Watch Next

While these trends provide opportunities both for investors and for strata and rental property managers, it will be important for them to keep an eye on trends like:

- Whether Canadian travel to the U.S. continues to drop. Source:

- Updates to BC’s STR rules as the province refines compliance. Source: BC Government STR Act Updates.

- The impact of interest-rate adjustments on the recreational markets. Source: Royal LePage outlook.

- Municipal tax and zoning changes affecting second homes.

Staying informed is critical to success for real-estate professionals, now more than ever.

Rental Property and Strata Management Companies: Partner With Us

👉 GOBC is partnering with BC-based companies to train and recruit future strata and property managers. Call our office at +16042393575 to learn more.

Participate in the BC Rental Property and Strata Management Workforce Survey

👉 Help shape the future of the profession and support better training, standards, and hiring practices across the province. Take the survey.

0 Comments